Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

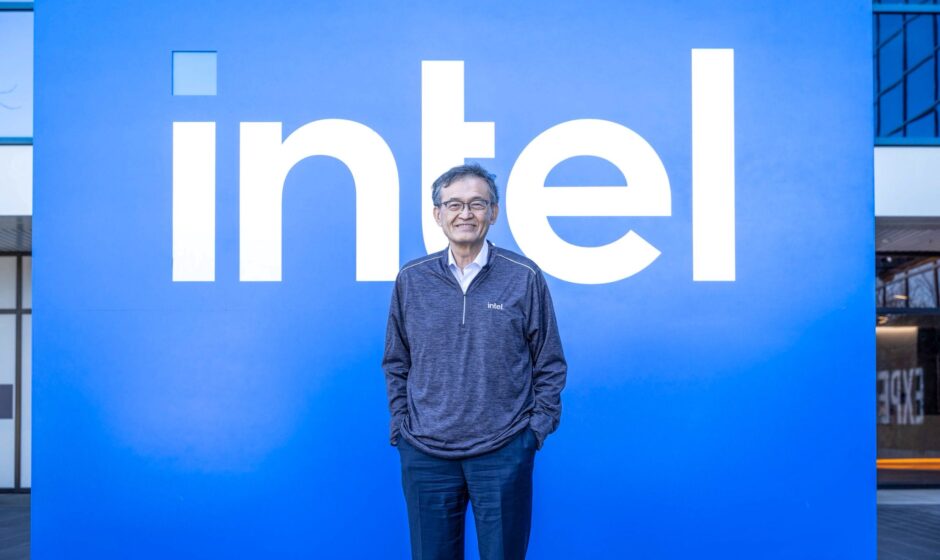

The Intel drama refuses to die down, and after President Donald Trump lashed out at its CEO Lip-Bu Tan, calling for his immediate resignation, he has defended himself in an employee memo posted publicly on its website.

In his memo, Tan said, “There has been a lot of misinformation circulating about my past roles at Walden International and Cadence Design Systems.” He countered the ethical allegations leveled against him and added, “Over 40+ years in the industry, I’ve built relationships around the world and across our diverse ecosystem – and I have always operated within the highest legal and ethical standards. My reputation has been built on trust – on doing what I say I’ll do, and doing it the right way. This is the same way I am leading Intel.”

Trump Called for Tan’s Resignation

For context, in a post on Truth Social, Trump had said that Tan is “highly CONFLICTED” and that there is “no other solution to this problem.”

Trump’s comments come shortly after reports said that he is pushing Taiwan Semiconductor Manufacturing Company (TSMC) to acquire a 49% stake in Intel.

Also, this extraordinary intervention into a private company’s leadership was preceded by a letter sent by Senator Tom Cotton to Intel’s chairman. Cotton’s letter expressed serious concerns over Tan’s extensive business ties to Chinese firms, with some allegedly having links to the Chinese People’s Liberation Army (PLA).

Referring to the nearly $8 billion grant that Intel received from the CHIPS Act, the largest for any company, Cotton said, “Intel is required to be a responsible steward of American taxpayer dollars and to comply with applicable security regulations.” He added, “Mr. Tan’s associations raise questions about Intel’s ability to fulfill these obligations.”

Notably, in April, Reuters reported exclusively that Tan invested more than $200 million in hundreds of Chinese advanced manufacturing and chip firms, some of which were linked to the PLA. Tan either made the investments individually or channeled them through venture funds he founded or operated.

Tan Defends Himself Against the Allegations

While Tan did not provide any specifics in his memo, he said, “We are engaging with the Administration to address the matters that have been raised and ensure they have the facts.”

The Intel CEO added, “I fully share the President’s commitment to advancing U.S. national and economic security, I appreciate his leadership to advance these priorities, and I’m proud to lead a company that is so central to these goals.”

Tan, a veteran of the semiconductor industry, was appointed as Intel’s CEO in March, a few months after the previous CEO Pat Gelsinger abruptly resigned.

Intel Has Been Trying to turn around Its Business

Notably, Gelsinger, a former Intel executive, returned as the CEO in 2021 amid the chipmaker’s woes. He outlined his IDM 2.0 turnaround strategy to revive the business. As part of that strategy, it worked on innovation in the chip design business to effectively compete with the likes of AMD and Nvidia. The second leg of the turnaround strategy was pivoting the company to the foundry business, where Intel started building chips for other companies. Finally, Intel started unlocking value in its subsidiaries and successfully listed Mobileye.

However, the strategy did not yield the desired results, and Intel has not innovated effectively, resulting in a significant loss in the artificial intelligence chip market, as its Gaudi chip failed to gain traction. The company’s foundry business has been even troublesome, and that segment has accumulated multi-billion-dollar losses.

Gelsinger’s Turnaround Strategy Did Not Yield the Desired Results

While Gelsinger had outlined ambitious plans for Intel’s foundry business, it has failed to attract third-party customers even as pure-play foundries like Taiwan Semiconductor Manufacturing Company have seen their order books swell amid the AI pivot.

In a July filing with the SEC, Intel said it may “pause or discontinue” its foundry business if it is not able to secure customers.

“We have been unsuccessful to date in securing any significant external foundry customers for any of our nodes, and our prospects for securing a significant external foundry customer for Intel 14A are uncertain,” said Intel’s filing.

The burgeoning losses in the foundry business have weakened Intel’s balance sheet, which had over $44 billion in debt at the end of the second quarter. Credit rating agencies have also taken note of the company’s woes, and recently, Fitch downgraded Intel’s credit rating by one notch while assigning a negative outlook on the chipmaker.

It joins credit rating peers S&P Global and Moody’s, which have previously downgraded the Santa Clara, California-headquartered company’s credit rating.

Tan Has Also Been Trying to Revive Intel

Tan is working on a long-term plan to turn around Intel and outlined the strategy during the Q1 2025 earnings call. Firstly, he said that the company will focus on product development, stressing “best products always win.”

Secondly, he said that Intel will “refine” its AI strategy. “Our goal will be to take our integrated system and platform view to develop full-stack AI solutions that enable more accuracy, power efficiency, and security for our enterprise customers,” said Tan during the earnings call.

Thirdly, he talked about “building trust with foundry customers.” Gelsinger had big plans for Intel’s foundry business, but that segment has sagged and has been saddled with billions of dollars in losses.

Finally, he said that Intel will strengthen its balance sheet. He, however, said that the company has decided not to “spin off Intel Capital, but to work with the team to monetize our existing portfolio while being more selective on new investments that support the strategy.”

Intel Stock Has Crashed

Intel stock has crashed and fallen to a multi-year low last year. Amid its worsening financials, the company has slashed thousands of jobs and suspended its dividend. The company has had four CEOs in seven years, but leadership changes haven’t had much impact on its fortunes, and the company continues to lose market share.

Intel’s woes are far from over, and Nvidia, AMD, and Qualcomm are looking to further eat into its PC market share with Arm-based semiconductors. While there have been intermittent rumors about Intel trying to sell itself, either in parts or in entirety, none of these have come to fruition, as potential buyers seem wary about strategic fit, Intel’s bloated debt pile, and likely regulatory hurdles.

#Intel #CEO #Defends #Trump #Called #Resignation