Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

China’s May retail sales jumped 6.4% YoY in May and far exceeded the 5% growth that analysts were expecting as the massive subsidies provided by the Chinese government and the “618 shopping festival” helped uplift sales. However, the country’s overall May economic data was a mixed bag, with industrial output missing estimates.

China’s May Economic Data Was Mixed

China’s industrial output grew by 5.8% in May. This eased slightly from April’s 6.1% growth and was the slowest increase since November 2024. The country’s fixed asset investment grew by 3.7% in the first five months of 2025. This was a slight deceleration from the 4% growth in the first four months. Manufacturing investment remained strong at 8.5%, while real estate development investment continued to decline, down 10.7%.

China’s urban unemployment rate stood at 5% in May, a slight decrease of 0.1 percentage points from April and the lowest since November.

Meanwhile, the key takeaway from China’s May economic report was the retail sales, whose growth was the highest since December 2023, as China’s subsidies and the 618 shopping festival led to a revival in consumption.

The 618 Shopping Festival is China’s second-biggest such event after Singles’ Day (11.11). The midyear shopping festival, which is primarily focused on online sales, started early this year, and with a stretch of almost 40 days, it was the biggest ever since it was started by Chinese e-commerce giant JD.com in 2004.

China Provided Several Subsidies to Spur Growth

China took both monetary and fiscal measures to support its economy, which is suffering from structural issues ranging from slow growth in domestic consumption, an aging economy, a property market slump, and external risks emanating from tariffs on Chinese exports by several countries, including the US, which is its biggest trading partner.

The country launched a trade-in program for consumer products, provided a subsidy for purchases, and some local governments even issued consumption vouchers.

In March, China announced a “Special Action Plan to Boost Consumption” to “enhance consumption capacity by increasing income and reducing burdens.” Among others, the country is taking steps to promote inbound and domestic tourism, particularly in areas that get snow.

China’s Population Declined Last Year

The broad-based plan also talks about setting up pediatric outpatient clinics at night in general hospitals and encouraging community and employer-run childcare services. Notably, China has been grappling with an aging population, and efforts to cajole people to have more kids have not yielded the desired results, with the population falling for the last three consecutive years.

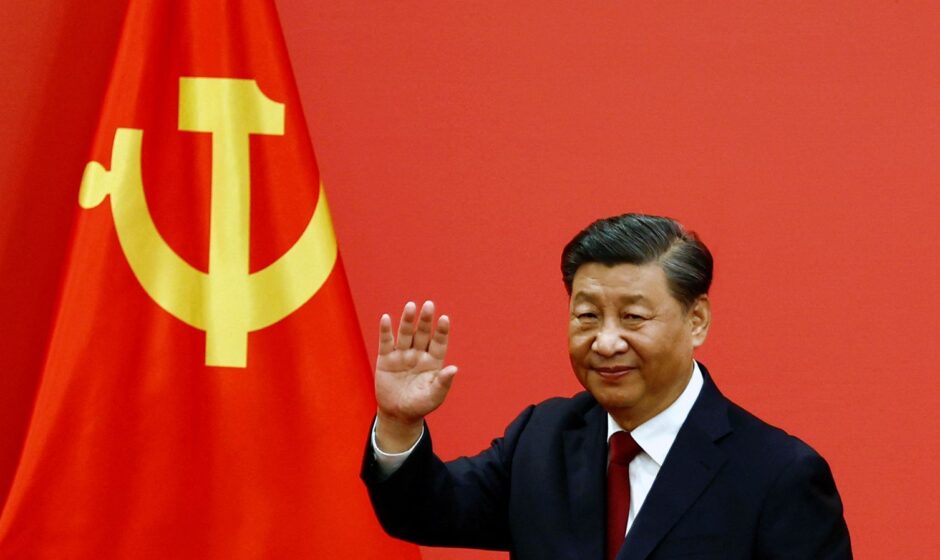

The country also took several measures to improve sentiments and bolster confidence in its business sector. In February, Chinese President Xi Jinping met the country’s entrepreneurs, including Alibaba’s co-founder Jack Ma, at a symposium, which was seen as a sign of support for the country’s tech sector. The meeting was quite notable as Xi cracked down on tech companies, including Alibaba, in 2020 and 2021, which made Chinese stocks “uninvestible” for many foreign investors.

China’s Stimulus Helped Spur the Economy

China’s stimulus measures, which the country started unleashing in September last year, helped support its economy. The world’s second-largest economy expanded at an annualized pace of 5.4% in Q1, which was ahead of the 5% growth that economists were expecting. The country is targeting a 5% GDP growth for this year, which is similar to last year’s pace.

These measures have helped support China’s growth at a time when it is facing serious headwinds in the external sector, and at its peak, US President Donald Trump imposed a 145% tariff on imports from China. While the US has since brought down the tariffs to 55% as the two countries negotiate a trade deal, these are still quite high and are expected to negatively impact China’s exports to the US.

Analysts on China’s Growth Outlook

While China’s May retail sales showed strong growth, some analysts doubt that the growth is sustainable. “We find a general pattern that wherever there is stimulus, it works, like the home appliance sales; but wherever there is no stimulus, like the property development, it struggles,” said Tianchen Xu, senior economist at the Economist Intelligence Unit.”

Tianchen added, “There are reasons for more caution going forward, especially regarding private consumption which could see a ‘triple whammy’ of tightening dining curbs on officials, the end of a front-loaded 618 shopping festival and the suspension of government consumer subsidies.”

Jianwei Xu, senior economist at Natixis, echoed similar views and, in an email to CNBC, said, “Absent further demand-side stimulus, we expect that the consumption recovery will be short-lived.”

Zichun Huang, China Economist at Capital Economics, also believes that the Chinese economy is losing momentum and said, “The US-China trade truce was not enough to prevent a broader loss of economic momentum last month.” He added, “With tariffs set to remain high, fiscal support waning and structural headwinds persisting, growth is likely to slow further this year.”

China Raised Its Fiscal Deficit Target

China raised its 2025 budget deficit target to “around 4%” of GDP, which was in line with estimates and 100 basis points higher than the previous year. While there are concerns over high debt, last year the country said that it still has much room to raise its fiscal deficit. However, amid a structurally slowing economy, pressure on its export sector due to US tariffs, and an already bloated debt pile of local governments, many analysts believe the country faces a tough task in achieving its growth targets.

#Chinas #Retail #Sales #Surpass #Estimates #Subsidies #Shopping #Festival