Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

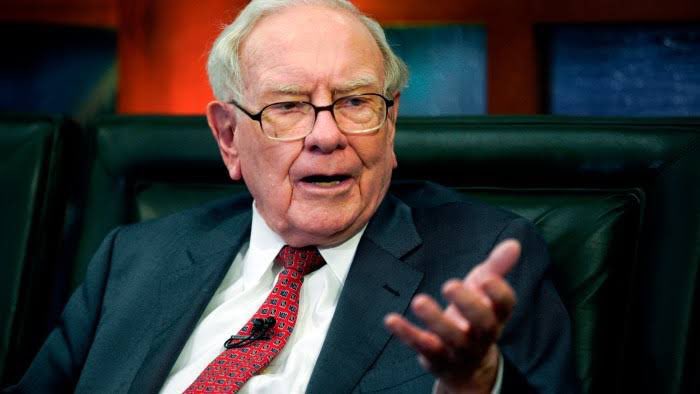

Berkshire Hathaway held its annual meeting yesterday. At that event, CEO Warren Buffett announced his retirement after heading the company for six decades. Here are the key takeaways from the company’s annual meeting.

“Tomorrow, we’re having a board meeting of Berkshire, and we have 11 directors. Two of the directors, who are my children, Howie and Susie, know of what I’m going to talk about there. The rest of them, this will come as news to, but I think the time has arrived where Greg should become the chief executive officer of the company at year end,” said Buffett at the meeting.

Buffett Announces His Retirement from Berkshire

Meanwhile, even though Buffett announced his retirement, he stressed that he did not intend to sell his stake in the conglomerate. I have no intention, zero, of selling one share of Berkshire Hathaway. It will get given away gradually,” said Buffett.

He added, “I would add this: The decision to keep every share is an economic decision, because I think the prospects of Berkshire will be better under Greg’s management than mine.”

“But I will come in, and there may come a time when we get a chance to invest a lot of money. When that time comes, I think it may be helpful with the board — the fact that they know I’ve got all my money in the company, and I think it’s smart, and I’ve seen what Greg has done,” said the “Oracle of Omaha” reaffirming his faith in Abel’s leadership.

Abel, on his part, signaled continuity at the conglomerate that owns multiple businesses apart from stakes in publicly traded companies. “It’s really the investment philosophy and how Warren and the team have allocated capital for the past 60 years,” said Abel. He added, “Really, it will not change. And it’s the approach we’ll take as we go forward.”

Buffett Weighed in On Tariffs

While Buffett’s retirement, which was disclosed towards the end of the annual meeting, is making all the news, there were some other key takeaways from the event. For instance, Buffett weighed in on the tariffs and said, “Trade should not be a weapon.”

He added, “I do think that the more prosperous the rest of the world becomes, it won’t be at our expense, the more prosperous we’ll become, and the safer we’ll feel, and your children will feel someday.”

Previously also Buffett took a swipe at the tariffs, saying, “Over time, they are a tax on goods. I mean, the tooth fairy doesn’t pay ’em!”

Several economists have warned of a recession due to President Trump’s tariffs. JPMorgan, for instance, has raised the odds of a US recession this year to 60% as compared to 40% before the tariff announcement. In his note, Bruce Kasman, head of global economic research, said, “These policies, if sustained, would likely push the US and possibly global economy into recession this year.”

While Trump sees tariffs as a tool to address the country’s burgeoning trade and budget deficit, many economists believe that they would only end up raising costs for Americans. Jeremy Siegel, professor at the University of Pennsylvania’s Wharton School, said, “I think this is the biggest policy mistake in 95 years.”

Most of Berkshire’s Holdings Are in the US

Buffett, who predominantly invests in US companies, does not see the tariffs as a serious headwind to US leadership. He said, “We’ve gone through great recessions, we’ve gone through world wars, we’ve gone through the development of an atomic bomb that we never dreamt of at the time I was born, so I would not get discouraged about the fact that it doesn’t look like we’ve solved every problem that’s come along.”

The nonagenarian added, “If I were being born today, I would just keep negotiating in the womb until they said you can be in the United States.”

Buffett Warns on Soaring Deficit

Meanwhile, Buffett warned about the soaring budget deficit, saying, “We are operating at a fiscal deficit now that is unsustainable over a very long period of time. We don’t know whether that means two years or 20 years, because there’s never been a country like the United States, but this is something that can’t go on forever.”

The US budget deficit has spiked ever since the country opened up its coffers to support the economy amid the COVID-19 pandemic. Deficit hit a record high of $3.13 trillion in the fiscal year 2021 but subsequently came down to $2.77 trillion in the next fiscal year. The deficit fell to $1.38 trillion in the fiscal year 2023, but in the fiscal year 2024, the budget deficit increased to $1.8 trillion.

Thanks to the elevated deficit, the US national debt has surpassed $36 billion and is almost 123% of the GDP. For context, the ratio was under 60% at the beginning of this century and has risen significantly since then.

The deficit has continued to rise in the current fiscal year. The US government’s budget deficit rose to $1.3 trillion in the first six months of the current fiscal year, which is the second highest ever.

Fed Chair Jerome Powell has Been Cautioning on the Ballooning Deficit

Fed chair Jerome Powell has also been sounding an alarm over the ever-rising US debt pile. “It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path,” said the Fed chair last year in an interview with CBS’s “60 Minutes.”

More recently, speaking at the Economic Club of Chicago last month, Powell warned that “the federal debt in the United States is on an unsustainable path, but it has not yet reached an unsustainable level, and no one really knows how much further we can go.”

Powell stressed that the deficit is not a “Federal Reserve problem” and questioned the discretionary spending cuts targeted by politicians while the real problem lay elsewhere. “The largest and fastest-growing portions are Medicare, Medicaid, Social Security, and now interest payments, so this is indeed where efforts need to be focused, and these issues can only be resolved on a bipartisan basis; neither side can find a solution without the involvement of both, so this is crucial,” said Powell.

Buffett Weighs in on Volatility

Berkshire’s cash pile rose to a record high of $347.7 billion at the end of Q1, and while Buffett said that the conglomerate was close to doing a $10 billion deal,l but eventually held back. Buffett, however, downplayed the recent market volatility and said, “What has happened in the last 30, 45 days … is really nothing.”

Buffett said that over the last six decades, there have been three instances when Berkshire shares lost 50% in value and added, “I don’t get fearful by things that other people … are afraid of in a financial way.”

He emphasized, “Let’s say Berkshire went down 50% next week, I would regard that as a fantastic opportunity, and it wouldn’t bother me in the least.”

#Berkshire #Hathaway #Annual #Meeting #Warren #Buffett #Announces #Retirement